Sales Tax On Pet Food Massachusetts . what purchases are exempt from the massachusetts sales tax? According to the ma department. while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. The sales tax calculator will. Are prescription medications and prescription pet food exempt from ma sales tax? although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. While the massachusetts sales tax of 6.25% applies. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts.

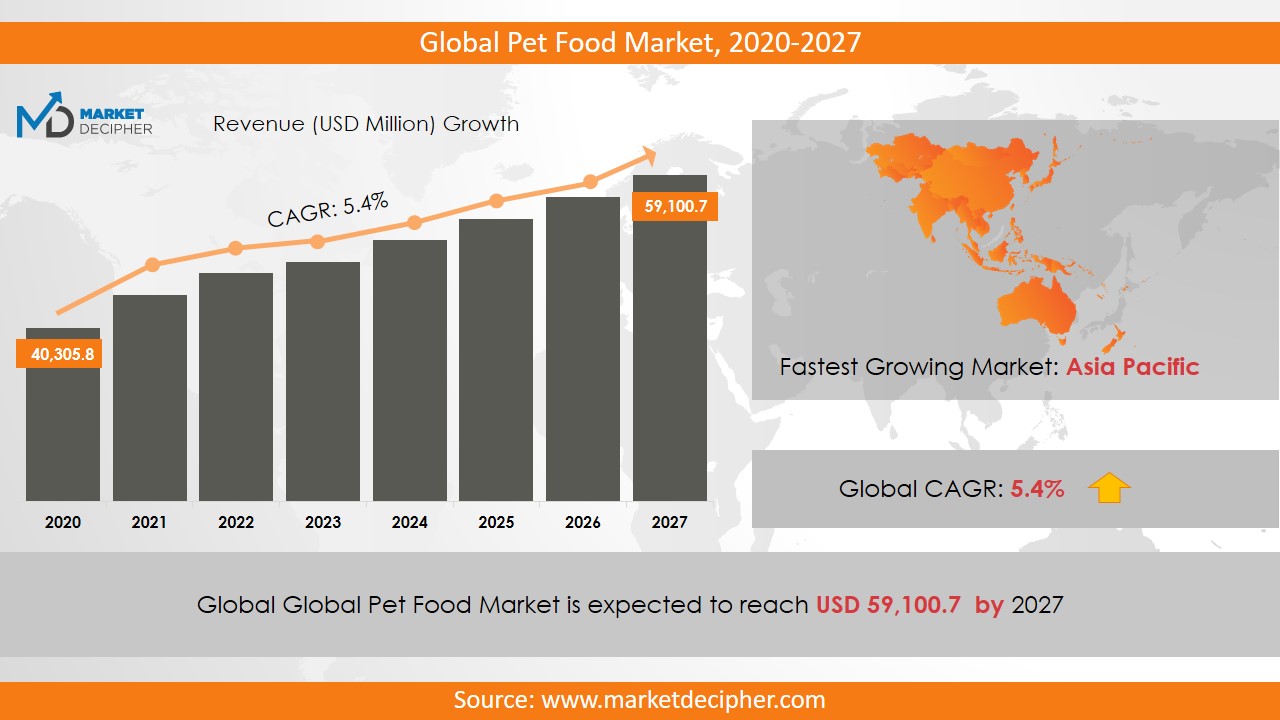

from www.marketdecipher.com

massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. While the massachusetts sales tax of 6.25% applies. The sales tax calculator will. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. what purchases are exempt from the massachusetts sales tax? while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. Are prescription medications and prescription pet food exempt from ma sales tax? According to the ma department.

Global Pet Food Market Report 2019 2026, Sales Volume, Revenue

Sales Tax On Pet Food Massachusetts what purchases are exempt from the massachusetts sales tax? the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. what purchases are exempt from the massachusetts sales tax? although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. According to the ma department. Are prescription medications and prescription pet food exempt from ma sales tax? While the massachusetts sales tax of 6.25% applies. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. The sales tax calculator will. massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

From www.youtube.com

Pet Food Market 20192024 Global Industry Overview, Sales Revenue Sales Tax On Pet Food Massachusetts Are prescription medications and prescription pet food exempt from ma sales tax? massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. although massachusetts still levies a 6.25 percent. Sales Tax On Pet Food Massachusetts.

From abbeycaitlin.pages.dev

Tax Free Weekend 2024 Missouri State Adena Larisa Sales Tax On Pet Food Massachusetts massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The sales tax calculator will. while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. what purchases are exempt from the massachusetts sales tax? massachusetts sales tax calculator. Sales Tax On Pet Food Massachusetts.

From market.us

DirecttoConsumer(DTC) Pet Food Market Size CAGR of 25.1 Sales Tax On Pet Food Massachusetts while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. According to the ma department. While the massachusetts sales tax of 6.25% applies. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. The sales tax calculator will. massachusetts sales tax. Sales Tax On Pet Food Massachusetts.

From www.cbpp.org

States That Still Impose Sales Taxes on Groceries Should Consider Sales Tax On Pet Food Massachusetts While the massachusetts sales tax of 6.25% applies. Are prescription medications and prescription pet food exempt from ma sales tax? According to the ma department. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. what purchases are exempt from the massachusetts sales tax? The sales tax calculator will. the massachusetts. Sales Tax On Pet Food Massachusetts.

From logos-world.net

Top 20 Dog Food Brands Sales Tax On Pet Food Massachusetts According to the ma department. what purchases are exempt from the massachusetts sales tax? massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. massachusetts imposes a sales tax on. Sales Tax On Pet Food Massachusetts.

From www.youtube.com

6 PetRelated Tax Deductions YouTube Sales Tax On Pet Food Massachusetts massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. Are. Sales Tax On Pet Food Massachusetts.

From www.marketwatch.com

5 ways to claim your pets on your tax return MarketWatch Sales Tax On Pet Food Massachusetts massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. . Sales Tax On Pet Food Massachusetts.

From www.zrivo.com

Massachusetts Sales Tax 2023 2024 Sales Tax On Pet Food Massachusetts although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. While the massachusetts sales tax of 6.25% applies. The sales tax calculator will. According to the ma department. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. massachusetts. Sales Tax On Pet Food Massachusetts.

From www.sphericalinsights.com

Global Pet Food Ingredients Market Size, Share, Growth 2030. Sales Tax On Pet Food Massachusetts Are prescription medications and prescription pet food exempt from ma sales tax? massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. While the massachusetts sales tax of 6.25% applies.. Sales Tax On Pet Food Massachusetts.

From trends.edison.tech

Online Pet Food Sales Up 43 in July over Previous July Sales Tax On Pet Food Massachusetts massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. According to the ma department. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. While the massachusetts sales tax of 6.25% applies. Are prescription medications and prescription pet food exempt from. Sales Tax On Pet Food Massachusetts.

From cevmscht.blob.core.windows.net

What Is The Sales Tax On A Vehicle In Massachusetts at Larry Weaver blog Sales Tax On Pet Food Massachusetts According to the ma department. The sales tax calculator will. what purchases are exempt from the massachusetts sales tax? although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. massachusetts imposes a. Sales Tax On Pet Food Massachusetts.

From cejynklp.blob.core.windows.net

Does Massachusetts Have Sales Tax On Groceries at Ryan Jones blog Sales Tax On Pet Food Massachusetts The sales tax calculator will. what purchases are exempt from the massachusetts sales tax? While the massachusetts sales tax of 6.25% applies. Are prescription medications and prescription pet food exempt from ma sales tax? massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. while the state. Sales Tax On Pet Food Massachusetts.

From www.kynt1450.com

City Eyes Food Sales Tax Issue KYNTAM Sales Tax On Pet Food Massachusetts While the massachusetts sales tax of 6.25% applies. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. what purchases are exempt from the massachusetts sales tax? although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. Are prescription. Sales Tax On Pet Food Massachusetts.

From templates.esad.edu.br

Printable Sales Tax Chart Sales Tax On Pet Food Massachusetts massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. what purchases. Sales Tax On Pet Food Massachusetts.

From www.wtsp.com

Florida pet food tax break Lawmakers could approve it in budget Sales Tax On Pet Food Massachusetts what purchases are exempt from the massachusetts sales tax? massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. The sales tax calculator will. According to the ma department. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. the massachusetts sales. Sales Tax On Pet Food Massachusetts.

From topforeignstocks.com

Sales Tax on Grocery Items by State Chart Sales Tax On Pet Food Massachusetts massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. while the state sales tax rate is 6.25%, some cities and towns in massachusetts have added local sales. While the massachusetts. Sales Tax On Pet Food Massachusetts.

From www.petfoodprocessing.net

State of the US pet food and treat industry, 2019 20191219 Pet Sales Tax On Pet Food Massachusetts According to the ma department. massachusetts sales tax calculator is used to calculate the sales tax to buy things in massachusetts. massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal. Sales Tax On Pet Food Massachusetts.

From www.taxuni.com

Massachusetts Sales Tax 2023 2024 Sales Tax On Pet Food Massachusetts Are prescription medications and prescription pet food exempt from ma sales tax? While the massachusetts sales tax of 6.25% applies. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. what purchases are exempt from the massachusetts sales tax? while the state sales tax rate is 6.25%, some cities. Sales Tax On Pet Food Massachusetts.